正在热播

电影

更多电影

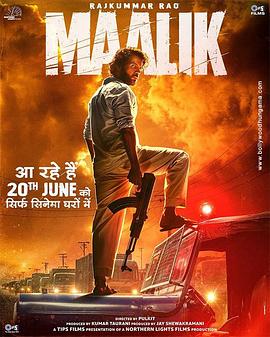

2025

动作片

印度

在《马利克》这部充满张力与深度的影片中,主角马利克是一位身陷家族恩怨与自我救赎漩涡的复杂人物。故事以一场突如其来的家族悲剧为引,揭开埋藏多年的权力争夺与情感纠葛。马利克被迫在忠诚与背叛之间做出抉择,同

HD

2025

恐怖片

西班牙

凯特·德尔·卡斯蒂洛 布鲁诺·比齐尔 Daniela Schmidt 伊万·马科斯 Garrett Wall Alex Diehl 肯·阿普多恩 Jhony Giraldo Megan Tyler Moreno 埃玛·苏亚雷斯

在《本能2025》中,一场科技与人性的致命博弈悄然展开。未来世界,人类欲望可通过神经植入系统被量化操控,犯罪心理学家林雪与系统设计师陈锐被迫联手追查一系列离奇命案。两人发现所有线索都指向一款名为“本能

HD

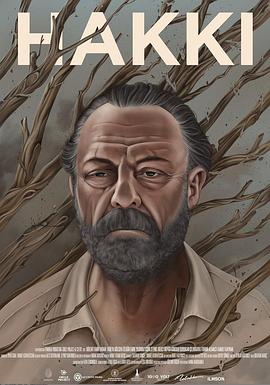

2024

剧情片

土耳其

Bülent Emin Yarar Hülya Gülsen Irmak Cem Zeynel Kili? ?zgür Emre Yildirim Duygu G?khan Durukan ?elikkaya

《哈基》讲述了一位名叫哈基的流浪少年在都市边缘挣扎求生的动人故事。衣衫褴褛却眼神倔强的哈基,每日依靠捡拾废品与打零工勉强维生,直到他在废弃车站偶遇了神秘独居老人老金。两人从最初的戒备试探,逐渐发展出跨

HD

2024

犯罪片

西班牙

米格尔·埃尔南 苏珊娜·阿巴图纳·戈麦斯 亚历山德拉·玛桑凯 Stanzin Gonbo Sonam Angchok 伊万·雷内多 Morup Namgyal Kunga Dodon Tsewang Lazes Stanzin Sharap Leo Medina Carla León 帕维尔·安东 Jerome Cabodoc Eloisa Luján Yasoda Goteea Mahesh Harjani

在神秘莫测的《暗影谷》,一位失去记忆的年轻探险家艾琳意外闯入这片被远古诅咒笼罩的禁地。她与隐居山谷的老猎人卡尔结成盟友,两人在迷雾笼罩的森林中寻找真相,却逐渐发现山谷的异变与艾琳消失的过去有着惊人关联

HD

2025

恐怖片

韩国

TC

2008

剧情片

中国香港

HD

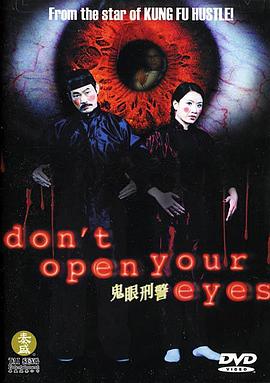

2001

恐怖片

中国香港

HD

2025

喜剧片

中国大陆,中国香港

TC抢先版

2025

喜剧片

中国大陆,中国香港

TC

2024

恐怖片

墨西哥

在神秘病毒席卷都市的危机背景下,《魔种入体》讲述了平凡程序员张默意外被植入远古魔种,身体逐渐异变并觉醒超能力的故事。他不仅要面对政府特工的追捕和神秘组织的利用,更需在人性与魔性的拉扯中守护家人与挚爱。

HD

1992

剧情片

中国香港

HD

2025

悬疑片

英国,美国

TC

2022

动作片

英国,美国

《坠落》讲述了两位爱好极限运动的闺蜜贝基与亨特之间惊心动魄的冒险故事。她们为了摆脱生活的沉闷,决定挑战一座高达600米的废弃电视塔,却因年久失修的梯架坍塌而被困塔顶。方寸之地的生存危机中,两人必须依靠

HD

1989

动作片

中国香港

HD

2002

剧情片

香港

HD中字

连续剧

更多连续剧

2025

国产剧

中国大陆

更新至06集

2025

国产剧

中国香港

更新至03集

2025

国产剧

中国香港

更新至03集

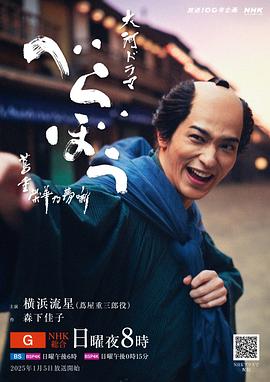

2025

日本剧

日本

更新至02集

更新至20集

2025

韩国剧

韩国

更新至50集

2025

日本剧

日本

更新至01集

2025

日本剧

日本

更新至66集

2023

日本剧

日本

更新至03集

2025

美国剧

美国

《海军罪案调查处:欧洲喋血篇》聚焦NCIS精英小队远赴欧洲破解一桩跨国要案。当一名海军军官在维也纳歌剧院离奇死亡,吉布斯带领团队与当地警方合作,却卷入牵扯多国势力的暗杀阴谋。剧情穿梭于历史悠久的欧洲地

更新至02集

2017

香港剧

中国香港

更新至2588集

2025

日本剧

日本

更新至01集

2025

日本剧

日本

更新至01集

2025

韩国剧

韩国

更新至01集

2025

日本剧

日本

更新至01集

综艺

更多综艺

2025

大陆综艺

大陆

更新至20250910期

2025

日韩综艺

韩国

《偶像庆典大作战:全国快闪巡演》讲述了人气偶像团体“Starlight”为挽救濒临解散的危机,毅然发起一场跨越十座城市的快闪巡演挑战。性格迥异的五位成员必须在有限的资金与时间内,秘密策划并执行每一场即

更新至03集

1997

港台综艺

中国台湾

更新至20250704期

2020

港台综艺

中国台湾

更新至20250701期

2020

港台综艺

中国台湾

更新至20250630期

2006

港台综艺

中国台湾

更新至20250630期

2011

港台综艺

中国台湾

更新至20250630期

2016

港台综艺

中国台湾

更新至20250630期

2025

大陆综艺

大陆

更新至20250701期

2025

大陆综艺

中国大陆

更新至20250701期

2023

港台综艺

中国台湾

更新至20250503期

2020

港台综艺

中国台湾

更新至20250630期

2020

港台综艺

中国台湾

更新至20250630期

动漫

更多动漫

2025

国产动漫

中国大陆

《这个年纪还能当大侠吗第二季》延续了第一季的热血与幽默,讲述年近中年的镖师张大川在江湖再起风云之际,毅然选择重出江湖,与一群性格迥异的“老伙计”共同对抗新兴邪派势力的故事。本季中,张大川不仅要面对家庭

更新至03集

2025

日韩动漫

日本

更新至01集

2025

日韩动漫

日本

更新至02集

2025

日韩动漫

日本

更新至01集

2023

国产动漫

中国大陆

更新至138集

2025

国产动漫

中国大陆

更新至08集

2025

日韩动漫

日本

更新至01集

2024

国产动漫

中国大陆

更新至83集

2025

国产动漫

大陆

在异世界迎来毁灭的时刻,主人公陈木带着无数神秘货币重生,醒来后发现自己已经变身为一名神秘投资者。而其他人为了一点微不足道的金钱而争斗时,陈木却开始了大手笔的投资行动,纷纷收购各种神秘场景。他不再被局限

更新至53集

2025

国产动漫

中国大陆

更新至05集

2025

日韩动漫

日本

《美食广场里的女高中生们在说啥》讲述了一群身穿校服的女高中生们在美食广场相遇并展开了一场别开生面的对话。她们谈论着学业压力、青涩的爱情和未来的憧憬,同时也分享着彼此的烦恼和快乐。在这个看似平凡的场景下,隐藏着每个人内心深处的故事和情感。这部影片通过轻松幽默的方式展现了青春期少女们的成长困惑和友谊之间的真挚情感,让观众感受到青春的美好与纯真。

更新至01集

2020

国产动漫

中国大陆

更新至178集

2025

日韩动漫

日本

更新至13集

2025

日韩动漫

日本

更新至01集

短剧

更多短剧

2025

女频恋爱

中国大陆

全集

2025

现代都市

中国大陆

全集

2025

古装仙侠

中国大陆

《我手执封神榜身背打神鞭下山》讲述了一位身负天命的神秘修士,手持掌控天地秩序的封神榜,身背可诛仙灭魔的打神鞭,毅然踏入凡尘乱世的传奇旅程。他本是昆仑山上的隐修弟子,为平息人间妖魔肆虐、朝纲崩乱的危局,

全集

2025

女频恋爱

中国大陆

全集

2025

年代穿越

中国大陆

全集

2025

现代都市

中国大陆

全集

2025

现代都市

中国大陆

《望父成龙父欲静而儿不止》讲述了一对性格迥异的父子在都市生活中碰撞出的温情喜剧。事业平庸的中年父亲一心渴望安稳度日,却偏偏有个精力旺盛、鬼点子频出的儿子,不仅对父亲的“躺平”心态嗤之以鼻,还千方百计逼

全集

2025

现代都市

中国大陆

全集

2025

现代都市

中国大陆

《爹地别慌萌宝厨神养全家》讲述了一位单身父亲在家庭陷入困境时,意外发现自己年幼的孩子竟拥有超凡厨艺天赋的温馨故事。原本手忙脚乱的爹地面对生活压力措手不及,却因萌宝化身“小厨神”彻底扭转局面。孩子用创意

全集

2025

年代穿越

中国大陆

《物价贬值,我穿回来后带飞全家》讲述了一位普通青年意外穿越到物价极速贬值的平行时空,历经挣扎后竟重返现实世界,并带着超前经济认知与机遇归来。面对原本为钱所困的平凡家庭,他巧妙利用异世经验,抓住时代转折

全集

2025

女频恋爱

中国大陆

《穿成炮灰女配,蔺总全家有救了》讲述现代职场女性意外穿越成小说中的炮灰女配,原本的命运是被豪门抛弃、结局凄惨。她却凭借智慧和魄力主动接近冷面总裁蔺总,不仅巧妙避开原剧情的陷阱,更一步步揭开了家族背后的

全集

2025

女频恋爱

中国大陆

全集

2025

现代都市

中国大陆

全集

2025

古装仙侠

中国大陆

全集

2025

现代都市

中国大陆

全集

最新影片

选择类型

全部

电影

连续剧

综艺

动漫

短剧

2025

女频恋爱

中国大陆

全集

2025

现代都市

中国大陆

全集

2025

古装仙侠

中国大陆

《我手执封神榜身背打神鞭下山》讲述了一位身负天命的神秘修士,手持掌控天地秩序的封神榜,身背可诛仙灭魔的打神鞭,毅然踏入凡尘乱世的传奇旅程。他本是昆仑山上的隐修弟子,为平息人间妖魔肆虐、朝纲崩乱的危局,

全集

2025

女频恋爱

中国大陆

全集

2025

年代穿越

中国大陆

全集

2025

现代都市

中国大陆

全集

2025

现代都市

中国大陆

《望父成龙父欲静而儿不止》讲述了一对性格迥异的父子在都市生活中碰撞出的温情喜剧。事业平庸的中年父亲一心渴望安稳度日,却偏偏有个精力旺盛、鬼点子频出的儿子,不仅对父亲的“躺平”心态嗤之以鼻,还千方百计逼

全集

2025

现代都市

中国大陆

全集

2025

现代都市

中国大陆

《爹地别慌萌宝厨神养全家》讲述了一位单身父亲在家庭陷入困境时,意外发现自己年幼的孩子竟拥有超凡厨艺天赋的温馨故事。原本手忙脚乱的爹地面对生活压力措手不及,却因萌宝化身“小厨神”彻底扭转局面。孩子用创意

全集

2025

年代穿越

中国大陆

《物价贬值,我穿回来后带飞全家》讲述了一位普通青年意外穿越到物价极速贬值的平行时空,历经挣扎后竟重返现实世界,并带着超前经济认知与机遇归来。面对原本为钱所困的平凡家庭,他巧妙利用异世经验,抓住时代转折

全集

2025

女频恋爱

中国大陆

《穿成炮灰女配,蔺总全家有救了》讲述现代职场女性意外穿越成小说中的炮灰女配,原本的命运是被豪门抛弃、结局凄惨。她却凭借智慧和魄力主动接近冷面总裁蔺总,不仅巧妙避开原剧情的陷阱,更一步步揭开了家族背后的

全集

2025

女频恋爱

中国大陆

全集

2025

现代都市

中国大陆

全集

2025

古装仙侠

中国大陆

全集

2025

现代都市

中国大陆

全集

2025

动作片

印度

在《马利克》这部充满张力与深度的影片中,主角马利克是一位身陷家族恩怨与自我救赎漩涡的复杂人物。故事以一场突如其来的家族悲剧为引,揭开埋藏多年的权力争夺与情感纠葛。马利克被迫在忠诚与背叛之间做出抉择,同

HD

2025

恐怖片

西班牙

凯特·德尔·卡斯蒂洛 布鲁诺·比齐尔 Daniela Schmidt 伊万·马科斯 Garrett Wall Alex Diehl 肯·阿普多恩 Jhony Giraldo Megan Tyler Moreno 埃玛·苏亚雷斯

在《本能2025》中,一场科技与人性的致命博弈悄然展开。未来世界,人类欲望可通过神经植入系统被量化操控,犯罪心理学家林雪与系统设计师陈锐被迫联手追查一系列离奇命案。两人发现所有线索都指向一款名为“本能

HD

2024

剧情片

土耳其

Bülent Emin Yarar Hülya Gülsen Irmak Cem Zeynel Kili? ?zgür Emre Yildirim Duygu G?khan Durukan ?elikkaya

《哈基》讲述了一位名叫哈基的流浪少年在都市边缘挣扎求生的动人故事。衣衫褴褛却眼神倔强的哈基,每日依靠捡拾废品与打零工勉强维生,直到他在废弃车站偶遇了神秘独居老人老金。两人从最初的戒备试探,逐渐发展出跨

HD

2024

犯罪片

西班牙

米格尔·埃尔南 苏珊娜·阿巴图纳·戈麦斯 亚历山德拉·玛桑凯 Stanzin Gonbo Sonam Angchok 伊万·雷内多 Morup Namgyal Kunga Dodon Tsewang Lazes Stanzin Sharap Leo Medina Carla León 帕维尔·安东 Jerome Cabodoc Eloisa Luján Yasoda Goteea Mahesh Harjani

在神秘莫测的《暗影谷》,一位失去记忆的年轻探险家艾琳意外闯入这片被远古诅咒笼罩的禁地。她与隐居山谷的老猎人卡尔结成盟友,两人在迷雾笼罩的森林中寻找真相,却逐渐发现山谷的异变与艾琳消失的过去有着惊人关联

HD

2025

恐怖片

韩国

TC

2008

剧情片

中国香港

HD

2001

恐怖片

中国香港

HD

2025

喜剧片

中国大陆,中国香港

TC抢先版

2025

喜剧片

中国大陆,中国香港

TC

2024

恐怖片

墨西哥

在神秘病毒席卷都市的危机背景下,《魔种入体》讲述了平凡程序员张默意外被植入远古魔种,身体逐渐异变并觉醒超能力的故事。他不仅要面对政府特工的追捕和神秘组织的利用,更需在人性与魔性的拉扯中守护家人与挚爱。

HD

1992

剧情片

中国香港

HD

2025

悬疑片

英国,美国

TC

2022

动作片

英国,美国

《坠落》讲述了两位爱好极限运动的闺蜜贝基与亨特之间惊心动魄的冒险故事。她们为了摆脱生活的沉闷,决定挑战一座高达600米的废弃电视塔,却因年久失修的梯架坍塌而被困塔顶。方寸之地的生存危机中,两人必须依靠

HD

1989

动作片

中国香港

HD

2002

剧情片

香港

HD中字

2025

国产剧

中国大陆

更新至06集

2025

国产剧

中国香港

更新至03集

2025

国产剧

中国香港

更新至03集

2025

日本剧

日本

更新至02集

更新至20集

2025

韩国剧

韩国

更新至50集

2025

日本剧

日本

更新至01集

2025

日本剧

日本

更新至66集

2023

日本剧

日本

更新至03集

2025

美国剧

美国

《海军罪案调查处:欧洲喋血篇》聚焦NCIS精英小队远赴欧洲破解一桩跨国要案。当一名海军军官在维也纳歌剧院离奇死亡,吉布斯带领团队与当地警方合作,却卷入牵扯多国势力的暗杀阴谋。剧情穿梭于历史悠久的欧洲地

更新至02集

2017

香港剧

中国香港

更新至2588集

2025

日本剧

日本

更新至01集

2025

日本剧

日本

更新至01集

2025

韩国剧

韩国

更新至01集

2025

日本剧

日本

更新至01集

2025

大陆综艺

大陆

更新至20250910期

2025

日韩综艺

韩国

《偶像庆典大作战:全国快闪巡演》讲述了人气偶像团体“Starlight”为挽救濒临解散的危机,毅然发起一场跨越十座城市的快闪巡演挑战。性格迥异的五位成员必须在有限的资金与时间内,秘密策划并执行每一场即

更新至03集

1997

港台综艺

中国台湾

更新至20250704期

2020

港台综艺

中国台湾

更新至20250701期

2020

港台综艺

中国台湾

更新至20250630期

2006

港台综艺

中国台湾

更新至20250630期

2011

港台综艺

中国台湾

更新至20250630期

2016

港台综艺

中国台湾

更新至20250630期

2025

大陆综艺

大陆

更新至20250701期

2025

大陆综艺

中国大陆

更新至20250701期

2023

港台综艺

中国台湾

更新至20250503期

2020

港台综艺

中国台湾

更新至20250630期

2020

港台综艺

中国台湾

更新至20250630期

2025

国产动漫

中国大陆

《这个年纪还能当大侠吗第二季》延续了第一季的热血与幽默,讲述年近中年的镖师张大川在江湖再起风云之际,毅然选择重出江湖,与一群性格迥异的“老伙计”共同对抗新兴邪派势力的故事。本季中,张大川不仅要面对家庭

更新至03集

2025

日韩动漫

日本

更新至01集

2025

日韩动漫

日本

更新至02集

2025

日韩动漫

日本

更新至01集

2023

国产动漫

中国大陆

更新至138集

2025

国产动漫

中国大陆

更新至08集

2025

日韩动漫

日本

更新至01集

2024

国产动漫

中国大陆

更新至83集

2025

国产动漫

大陆

在异世界迎来毁灭的时刻,主人公陈木带着无数神秘货币重生,醒来后发现自己已经变身为一名神秘投资者。而其他人为了一点微不足道的金钱而争斗时,陈木却开始了大手笔的投资行动,纷纷收购各种神秘场景。他不再被局限

更新至53集

2025

国产动漫

中国大陆

更新至05集

2025

日韩动漫

日本

《美食广场里的女高中生们在说啥》讲述了一群身穿校服的女高中生们在美食广场相遇并展开了一场别开生面的对话。她们谈论着学业压力、青涩的爱情和未来的憧憬,同时也分享着彼此的烦恼和快乐。在这个看似平凡的场景下,隐藏着每个人内心深处的故事和情感。这部影片通过轻松幽默的方式展现了青春期少女们的成长困惑和友谊之间的真挚情感,让观众感受到青春的美好与纯真。

更新至01集

2020

国产动漫

中国大陆

更新至178集

2025

日韩动漫

日本

更新至13集

2025

日韩动漫

日本

更新至01集

2025

女频恋爱

中国大陆

全集

2025

现代都市

中国大陆

全集

2025

古装仙侠

中国大陆

《我手执封神榜身背打神鞭下山》讲述了一位身负天命的神秘修士,手持掌控天地秩序的封神榜,身背可诛仙灭魔的打神鞭,毅然踏入凡尘乱世的传奇旅程。他本是昆仑山上的隐修弟子,为平息人间妖魔肆虐、朝纲崩乱的危局,

全集

2025

女频恋爱

中国大陆

全集

2025

年代穿越

中国大陆

全集

2025

现代都市

中国大陆

全集

2025

现代都市

中国大陆

《望父成龙父欲静而儿不止》讲述了一对性格迥异的父子在都市生活中碰撞出的温情喜剧。事业平庸的中年父亲一心渴望安稳度日,却偏偏有个精力旺盛、鬼点子频出的儿子,不仅对父亲的“躺平”心态嗤之以鼻,还千方百计逼

全集

2025

现代都市

中国大陆

全集

2025

现代都市

中国大陆

《爹地别慌萌宝厨神养全家》讲述了一位单身父亲在家庭陷入困境时,意外发现自己年幼的孩子竟拥有超凡厨艺天赋的温馨故事。原本手忙脚乱的爹地面对生活压力措手不及,却因萌宝化身“小厨神”彻底扭转局面。孩子用创意

全集

2025

年代穿越

中国大陆

《物价贬值,我穿回来后带飞全家》讲述了一位普通青年意外穿越到物价极速贬值的平行时空,历经挣扎后竟重返现实世界,并带着超前经济认知与机遇归来。面对原本为钱所困的平凡家庭,他巧妙利用异世经验,抓住时代转折

全集

2025

女频恋爱

中国大陆

《穿成炮灰女配,蔺总全家有救了》讲述现代职场女性意外穿越成小说中的炮灰女配,原本的命运是被豪门抛弃、结局凄惨。她却凭借智慧和魄力主动接近冷面总裁蔺总,不仅巧妙避开原剧情的陷阱,更一步步揭开了家族背后的

全集

2025

女频恋爱

中国大陆

全集

2025

现代都市

中国大陆

全集

2025

古装仙侠

中国大陆

全集

2025

现代都市

中国大陆

全集